In the garden: Dealing with sunscald

The drought and heat will create enough tree problems that we will have no control over but there are things we can do to protect at least some of the problems that weather can cause.

The drought and heat will create enough tree problems that we will have no control over but there are things we can do to protect at least some of the problems that weather can cause.

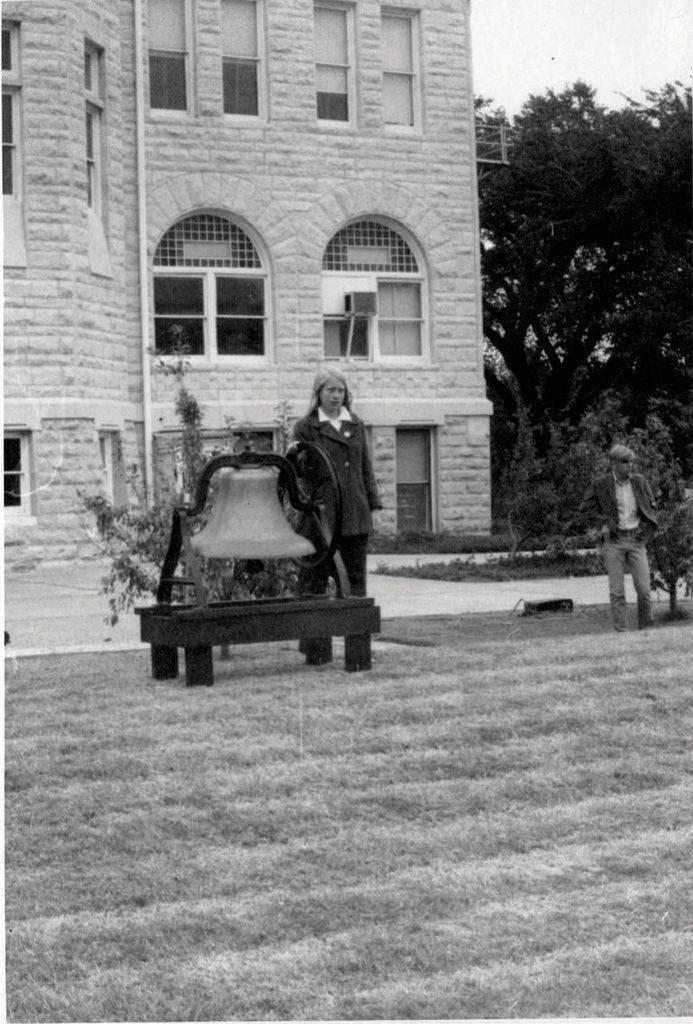

Kauffman Museum offers a trio of special programs for all interests during Bethel College’s Fall Festival, on Oct.

In the last nine years, Carol Schenk of Wichita has seen the assessed value of her home increase from $152,000 to $240,000 — pushing her annual property tax bill from $2,200 in 2014 to more than $3,000 in 2022.Schenk told lawmakers in a letter earlier this year that the tax on her nearly 30-year-old home is becoming too much.“I can’t even imagine what my new tax bill will be,” Schenk said, “but I am struggling to afford it right now.”Many Kansans have lined up at public meetings to say rising property values and the taxes that come with them are out of control.

Fall harvest is in full swing on our central Kansas farm.Do you live to work or work to live?

By Chad Frey Newton Kansan Harvey County is preparing for a tax sale, with a number of properties headed to the auction block on Nov.… Login to continue reading Login Sign up for complimentary access Sign Up Now Close

While the Newton City Commission accepted a recommendation to issue a special use permit for a bed and breakfast, the commission tabled a final decision on that application.The application came for a home at 2302 Paddington Ave., for an Airbnb “Hosted Home.”During the public hearing at the planning and zoning commission one neighbor spoke out in opposition, however members of the homeowner’s association reached out to city commission Clint McBroom.McBroom revealed during the Oct.

The crowd returned to precovid levels for the Taste of Newton last year, and Newton Area Chamber of Commerce director Pam Stevens is hoping they all return for the 36th annual event on Oct.

A unique opportunity is coming up at Diamond Springs Ranch, an opportunity to experience a bit of local history and folklore in a unique way.The ranch will offer a “Cowboy Experience After Dark,” after dark trail rides, on Oct.

This last weekend was the Frederic Remington Festival in Whitewater, an event that feature food booths, a pinewood derby, disc golf tournament and more in Whitewater.

Station U.S.